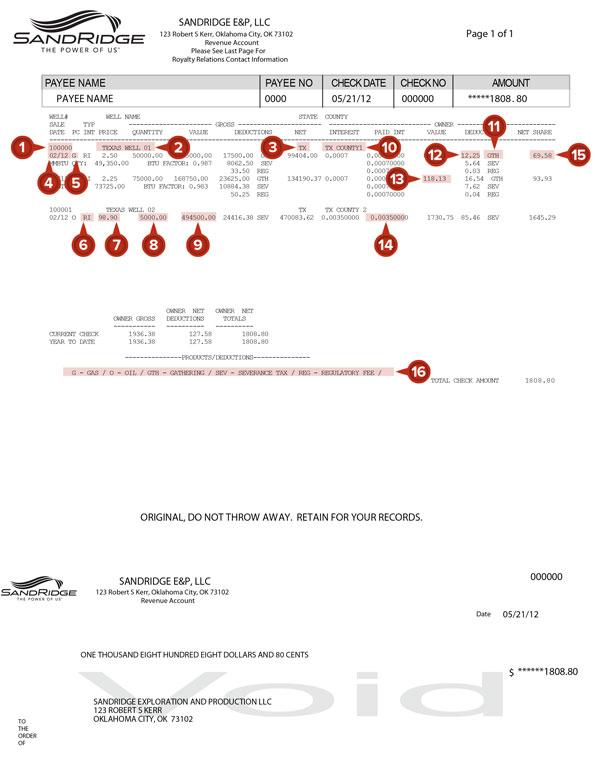

Revenue Check Stub Example

Please refer to this example for help with your check stub. State taxes have been deducted and paid where required. Have your lease number and owner number ready when contacting us.

No duplicates will be furnished. Retain this statement for tax purposes.

- Well or Lease identification number assigned by SandRidge

- Well Name

- State in which the well is located

- Product sales date in month/year format

- Product type (see #16)

- Interest type- WI-Working interest, RI-Royalty Interest, ORRI- Overriding Royalty Interest, etc.

- Price per unit sold

- Total well gross quantity sold

- Total well gross value = price times quantity

- County in which the well is located

- Deduction type (see #16)

- Owner deduction amount for each deduction type

- Owner gross value = well gross value x interest %

- Ownership decimal paid

- Owner net = owner gross less any deduction

- Product and deduction key to help you identify what products you are being paid on each well and what deductions are being withheld

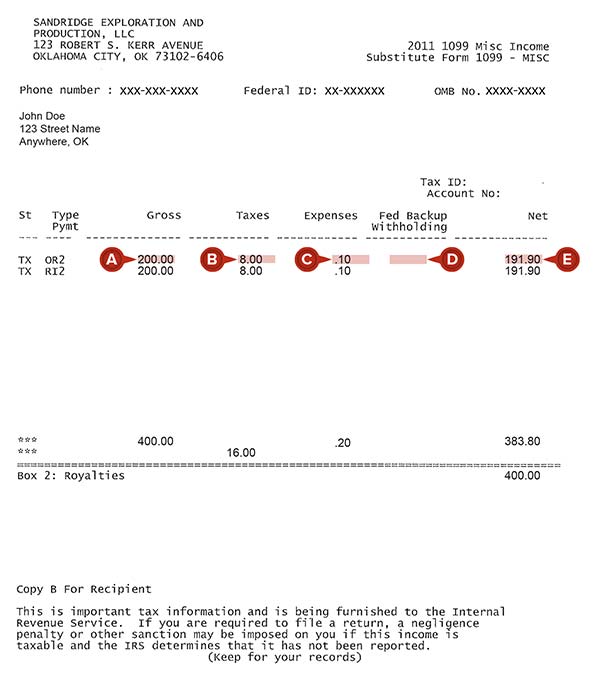

Revenue 1099 Example

Please refer to this example for help with your 1099.

- This amount represents the gross payments made to you during the tax year that were reported on Form 1099-MISC.

- This amount represents lease taxes (severance, etc.) associated with (A) that were remitted on your behalf.

- This amount represents post production lease expenses (gathering, etc.) associated with (A) that were paid on your behalf.

- This amount represents the Federal income tax withheld associated with (A) that was remitted on your behalf.

- This amount represents the net payments made to you during the tax year associated with (A).